Morgtage Rates Still High, A Great Time To Buy Tradelines

Posted on 30 April, 2024 by MIRANDA BOTTAS in Buying Tradelines

Soon we'll be closing in on a year since we spoke heavily about the need to buy tradelines if you're going to be purchasing a home using financing. With the economy so far disconnected from the stock market and industries continually heading in unpredictable directions, it's no longer a safe bet to simply wait it out. We said before that the time to buy is now. If you still haven't done it, we're still speaking to you. Stop waiting!

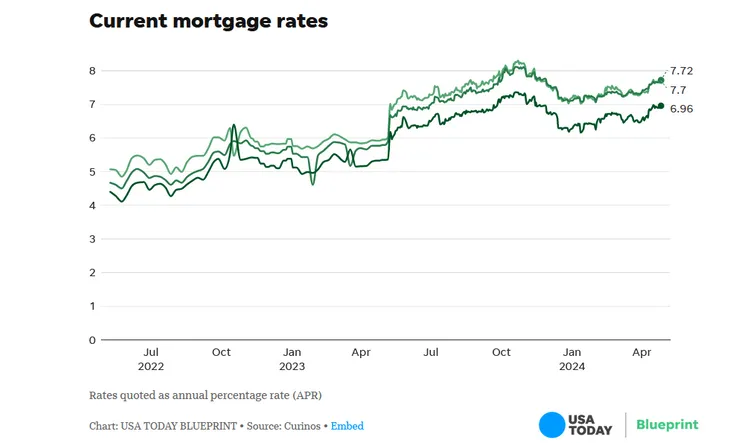

Over a year ago, in March of 2023 we wrote about how housing affordability was at it's lowest level ever recorded. This was followed by the highest average car prices coming in just months later in June, as noted in this July article by Kelley Blue Book. During this time, home mortgage interest rates continued to climb into October of last year, making record highs that hadn't been seen in decades.

With average national rates at 8.3% average on 30-year fixed mortgage loans, it was something that everyone was talking about. Yet, we were assured they'd drop down, if we just held out. And drop down is exactly what they did, by slightly over 1% as they fell to 7.02% in mid-January this year before gaining traction back upward. Today is April 29th of 2024, and the average 30-year fixed mortgage in the USA sits at a balmy 7.7%. See the chart below from USA Today for up-to-date information.

(UPDATE: as of today, February 7th, 2025 - USA average national mortgage rates for 30-year fixed are at 6.89%)

So what gives? Unfortunately we're not financial experts or advisors. What we can say with confidence however is that things don't seem to be changing very much. If it's not one thing it's another. While the fed has stopped interest rate hikes for the time being and speaks about plans of cutting them, it can only be taken with a grain of salt. 8 months ago they told us we'd already be well into ther planned rate cuts. Since then, that plan fell apart and the latest news looks like we might see a rate cut before the end of the year. Our advice? Don't hold your breath! There are so many off-balanced factors playing major economic roles right now that the cause and effect doesn't even seem possible to grasp, let alone predict.

In the past 2 years, the world's leading financial and economical experts have been wrong. Worse than wrong, they've been so far off track that it's almost comical. This has occurred time and time again. It's gotten to the point where it's really not even worth listening to and just making the moves that you need to make with complete disregard for what economists are telling you to do, whether it be wait, wait a little longer, or to simply think positive and keep on trucking. We hear so much talk about resilient consumers and how prices are maintainable because people are still buying and we're spending more than ever - but there's simple logic behind that which is somehow seemingly overlooked... people don't have a choice.

If food costs more, then we must spend more to eat. And if new cars cost more, than the charts will show that consumer spending on automobiles is higher than ever. The same goes for consumer energy costs such as gas and electricity. None of these are proof of a booming economy, they're simply the result of having to pay more because the prices are higher. There are a million-and-one ways to twist things to make it sound good, but when you look at the hard facts, there's isn't much beneficial movement happening. It's definitely not suddenly getting easier to survive as compared to say, 18 months ago.

Now, we're not here to be negative, but we also can't candy-coat the obvious data points. All of them lead to the same trends which show that we can expect continually higher living expenses and delayed relief - if we see any relief at all.

In regard to the housing market, you should really have made your decision already. If you're going to pull the trigger on a new home and a mortgage is the only way to make it happen, understand that there are options available. For example, you don't have to go with a fixed-rate mortgage. You can select something adjustable which may or may not be beneficial to you. You can also decide to buy in a less expensive area if that's an option for you, or to simply stay where you're at and not buy at all.

Whatever you decide upon, know that there's always more than just one solution. You could buy tradelines right now and improve your credit score by an incredible amount if things work in your favor. This would allow you to not only lock in a better interest rate (potentially saving you tens or hundreds of thousands of dollars by the time your mortgage is complete) but acquire a loan with less money down in some cases.

There's a lot to consider when making big decisions like buying a home, and a lot of important things that are required to be in tip-top shape such as your credit history, your income, and your current financial status. Additionally, a lot of the flexibility you'll receive will come from the lender you're working with, which makes it important to choose a good one that suits your needs. Just be sure to shop around before settling for the first offer or answer regarding home loans.

You could also chose to sell your home and rent something if you're willing and able to do it. However, it'd be ideal to do that in a situation where you already have some cash reserves so you don't burn through the money from your home sale. Simply living more frugally is another completely realistic option that many people tend to overlook or simply avoid.

Everything depends on what you need and how flexible you are. Just be sure that whatever you do, you don't catch yourself two years from now wishing that you'd taken action sooner.

PREVIOUS ARTICLE

If You Churn Credit Cards, You Should Be Selling Tradelines

NEXT ARTICLE

3 Tips On How To Sell Tradelines Successfully