What They're Not Telling You About Interest Rates And Loans

Posted on 28 June, 2023 by MIRANDA BOTTAS in Finance

Each week, and each and every month the same story continues. Contradiction after contradiction about the state of the US and global economy makes it almost impossible for the average consumer to make sense of practically anything regarding the economy.

Is the Fed decision to pause rate hikes good or bad? Are prices actually changing? Are costs going down? Are cars and housing more affordable? If not, will they be? If so, when? These are very hard questions to answer for the average person and if you watch closely, even the experts can't seem to get the story straight.

What we know for sure is that when we go grocery shopping or to our favorite restaurants, we notice a difference. We see prices continue to rise, and we see that every dollar we spend seems to buy less and less. This is because when we continually buy specific things we become accustomed to seeing and knowing what they cost. It's easier to distinguish the difference in pricing quite easily, even if the shock doesn't hit until we reach the checkout. Nonetheless, it's apparent. It's undeniable. It's taking a toll on our budgets, our savings, and our account balances.

We're told inflation is "cooling" for example. This tends to mean that it's still on a rapid rise, just at a slightly slower pace of rapid rising. We are now just a few days from July, and the "short-term, transitory inflation" that we were seeing in this time last year has not ceased to spread like an out of control wildfire. While we're not economists, we do know a few things and we understand very clearly that at this point in time, inflation is a prerequisite to keep the economy moving forward. Based on debt itself, there is actually no other way. If debt creation stopped and inflation reversed tomorrow, everything would come to a halt. This is a very complicated situation that is not easily explained nor understood, yet it is a fact.

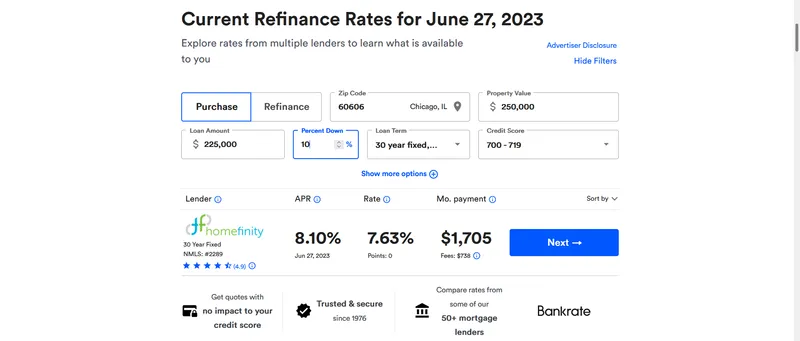

As of right now, an average 30-year fixed mortgage rate in Chicagoland for a $250k home with 10% down payment on a 700 to 719 credit score is a mind-boggling 8.1% at $1,705 per month (see the image below this paragraph). If you double your down payment to 20%, it drops to 7.89% and $1,450 per month. While we keep in mind that these numbers are only a sample, you can understand that prices are still very, very high. yes, there are better rates to be had. There are cheaper lenders. There are also large differences depending on the term-length of the mortgage and the down payment. However, a 715 credit score isn't bad at all. So why so expensive?

When figuring averages and while providing news reports and updates, it's not uncommon to see "national averages" or "statewide averages" for interest rates being shown. But what they're not showing you is the credit score required to achieve those kinds of prices. And in many instances an average credit score will be used while at other times an above average score is used. It's almost as if they metrics are skewed to make things seem better than they are. Can we get the loan mentioned above into the mid 6% range? Sure we can. But that requires a credit score of 780+ and 40% down payment. This is an interesting observation, to say the least. In a way, it feels like an information scam.

Now, we cannot say that this is the situation with every person and every situation. We believe in fairness and transparency. You may (or may not) have a neighbor who just financed a new home at 6.2% but that doesn't tell us much about their credit score, their individual situation, their assets, the experience and relationship they hold with their lender, the repayment terms, or the location in which they made their purchase. We can't say that better deals are impossible to find because that would simply not be true. But we do have a concrete example for today from a specific lender with the figures to back it all up. And to us, that's the disappointing part.

An 8.1% rate on a rock-bottom priced home (according to median US home prices) in an expensive area is not anywhere near being "good". In fact, it's a terrible rate. We would never recommend anyone to take out such a loan for a 30-year term, and we hope that you wouldn't consider it. Yet, the problem is we don't always have the option to decide. If we need something, we often have to take what is available. Our advice to anyone facing this issue would certainly be to shop around for alternatives.

I Cant Find An Alternative. My Credit Simply Isn't High Enough.

When you're faced with the problem of not finding a reasonable or fair rate for financing, you encounter yourself stuck between a rick and a hard place. Do you really need this loan? Is it important to your future? Will securing it help your career and/or life plans? If the answer is yes, you might not have a choice. An 8% mortgage rate is all that's available to you, and it requires dumping in every last penny of your savings for the down payment.

Of course, you could try and wait it out - but if we flashback to September, October, and November of 2022, many planned to wait things out with the expectation that rates would be in the low 5% or even high 4% range by today. As we can see, this is a large area of concern. Where will rates be in October of this year? And by spring of 2024? We mentioned on previous occasions that buying as quickly as possible was likely the best move, and we mentioned this as far back as November and December of last year.

While we're not going to sit here and try to say "we told you so!", we would hope that you're beginning to get the message. Things are too unpredictable and the opinions, expectations, outlooks, and forecasts that we've heard over the last 10 months have not only failed but failed miserably.

What Can I Do? I Need To Buy A Home While It's Still Possible!

Another worry that many people have is that although rates are so high and unattractive, there is a very valid reason to be concerned that 6 months or a year from now, their credit score or down payment may not even allow them to qualify for anything at all. This is not a good feeling to have, and it's not fair or fun to make long-term financial decisions based on desperation. Then again, when you have no choice and you can't afford to roll the dice in hopes that things will reserve in your favor, you might be forced to act now while the guarantee of acquiring something is still a reality - no matter how high the interest rate is.

There is some good news throughout all of this, and it may be the answer you're looking for. It's proven to work, it's quick, and depending on your budget it can make a big difference in your ability to be approved for a mortgage loan that shows better terms, less money down, and a lower interest rate. The solution is to take a look into buying tradelines, authorized user tradelines to be exact.

To explain briefly, authorized user tradelines are credit card tradelines that you purchase from a third party. They vary in cost for a variety of reasons (you can learn more here) but they are legal, and they basically prime your credit score so that you can apply strategically for your financing when the timing is perfect, thereby getting the best possible deal on something you already know you want or need to purchase. They are readily available from a variety of trusted sources including ourselves - yes, GFS Group specializes in tradelines for sale, with over 8 years of experience and an impeccable record of customer service and satisfaction.

They (tradelines) might not be the solution for you and your specific circumstances, but you won't know until you take a look for yourself or speak with a specialist. Basically, to have a good impact on your credit score to the point where the purchase price is of value to you, you'll need to have a clean credit report. Perfect isn't necessary, but even if your score is low the importance lies in your history and the idea that you'll need it to be clean. You should have no recent late payments, nothing in collections or default, and nothing that's haunting or seriously debilitating your credit score. A few remaining balances can be dealt with - even higher balances - but negative remarks and late pays in recent months will definitely minimize or completely diminish your chances for success, so we can't recommend investing in tradelines when you're in that position.

The best thing you can do it give us a visit right now. Click on this link to get in contact with us today and let's see if and how we can assist you. We will do our best to help put an end to playing this never ending guessing game of where the economy is heading next.

PREVIOUS ARTICLE

Leveraging Tradelines in 2023: Fight Inflation, Earn Extra Income, And More

NEXT ARTICLE

Your Credit Score And Today's Mortgage Rate: What It Means