Buying a Home In A Difficult Economy

Posted on 24 March, 2023 by MIRANDA BOTTAS in Economy

We're back to discuss the housing and home buying predicament again. It seems like over the last 6 months we've felt the need to continually address our audience with general information regarding mortgages, seeing as it's been a wave of highs and lows and everything in-between.

As we discussed just recently, some instability in the banking sector is the latest news that is affecting home buyers and the general consumer outlook regarding the economy. We live in a time where actions are fueled by news at an ever increasing rate. That's to say that while news has always been a driver for the markets and consumer decision making, this age of rapid access to information can cause almost instant pivoting of the economy. In fact, it's so rapid that we often see instances where markets and sentiment go from full-speed-ahead to a complete stop and then begin racing forward again within a matter of mere hours. It's not always easy to keep track of, and if you're not on your toes you might miss out on a great opportunity.

Additionally, we live in a time where we're extremely busy - often to the point of being overwhelmed with information and struggling to keep up. This makes it difficult for most of us to stay in tune with what's happening in the financial world at any given moment. Apart from a quick newsflash or by catching the last 10 seconds of a radio discussion regarding these topics, you may find yourself complerely out of the loop. While GFS Group is not a go-to source for the latest news, we definitely keep an eye on the most important factors that can affect not only our customers, but potential clients and anyone in the market for buying a new home.

As specialists in offering tradelines for sale and as a leading tradeline company in the USA, it's important to us to understand what drives the housing market at any given time. It's critical and crucial for us to comprehend how our product inventory can benefit the general population. One of the largest factors in purchasing a new home - whether you're a seasoned home buyer or newbie - is the current interest rate.

Today as we write this article, it's a Friday and mortgage rates have dropped very slightly. Realistically speaking, it doesn't mean much overall since they're still extremely high from what we're used to seeing. We also cannot forget that apart from interest rates, the availability of homes for sale and their current prices are changing each week, if not more often. While prices may be up due to high demand one week, they can drop the next week while demand remains the same. Or demand can drop, yet prices can shoot up a few percent. It all depends on what's going on economically, and lately, that economic outlook isn't based on simple numbers or basic events. Instead, it's a complex and ever-changing set of complicated metrics which feel like they become more confusing by the day. Even seasoned economists have a hard time absorbing all the information and getting a good word out about what's happening before something new sends the markets or interest rates running in another direction. Trying to report on this is like playing a game of statistical pin-the-tail-on-the-donkey, and the moment you're about to slap your theory onto paper something else arrives that must be figured into the equation. If not, you'll be missing your target completely.

Is this a year to buy a home? Is this the year to wait it out? Will rates drop noticeably, will they linger, or will they fluctuate? Could we see a slow decline and a return to a more desirable and "normal" figure, or will things creep upward again when we least expect it? Nobody knows for sure and that makes this a good case for playing things smart.

What Should I Do If I Want To Buy A Home Right Now?

We don't want to tell you to wait, but we don't want to advise you to pull the trigger at this precise moment either. First off, we specialize in helping people achieve the best financial positions prior to making their largest purchases so that they can save money. While this naturally puts us on guard and at immediate attention to what's happening so we can be sure our services remain as functional and beneficial as possible, we (and our clients) must accept and understand that we're not expert financial advisors. Our specialty sits in the realm of expert strategy for raising your credit score in a way that external events will have as little impact on you as possible, but we can only do so much. There is a very definitive point where our knowledge cannot be mistaken for any sort of guarantee.

While keeping that in mind, what is our opinion on home buying? Well, that's a complex question but here are a few things to consider when making your decision...

Home Mortgages Can Always Be Refinanced

Yes, that even includes 30-year fixed rate mortgages (assuming that your contract doesn't specifically restrict refinancing - which is something you should never agree to so be careful of your loan terms and understand very clearly what you're getting yourself into). You don't have to take on an adjustable rate mortgage, and you don't have to pay the same rate for the next 30 years even if your initial interest rate is higher than you wish. If you find the perfect home and you have the right down payment, (assuming you're not going to struggle financially to put yourself into this home) you should never be fearful of making the purchase. Just always know what your options are.

Some mortgages do not allow for over-payment, as the lender wants to ensure they collect every penny of interest. The same can be said about refinancing. Certain mortgage loans might specify that the terms are set in stone for the first 36 months (or a varying time period) during which you wouldn't able to refinance. Take this all into consideration when making your calculations and don't be afraid to shop around and ask the tough questions.

You're the one paying, and the lender is making money from you. As much as you may want or need this home, they equally need your business. Don't forget that there's nothing wrong with asking about other options that suit your needs more comfortably, or, requesting more flexibility to meet ever-changing economic situations.

Your Credit Score is an Immense Factor

When purchasing a home comes into play. On a loan that is very long-term, interest payments can add up quickly. The amount you will pay over the span of 10, 20, or 30 years will be much higher than the actual purchase price of the home. Most people know and understand this but they don't always think about the consequences. We urge you to consider the consequences very carefully. You're making a serious commitment and it isn't something that should be taken lightly.

Don't jump in due to fear of missing out, but equally, don't miss out for fear of the uncertain. Inform yourself, and make the choice that makes the most sense. This includes checking each and every aspect of your credit report to ensure complete accuracy at every point. You want that report to be as perfect as it can be, and you want your score to be as high as it can possibly be before applying, negotiating, and securing your mortgage and signing on the dotted line.

If you feel you could benefit from a higher credit score, take action before you finance. Look into squeezing every last point out of it, including taking a look at how buying a tradeline can take your financing experience to the next level.

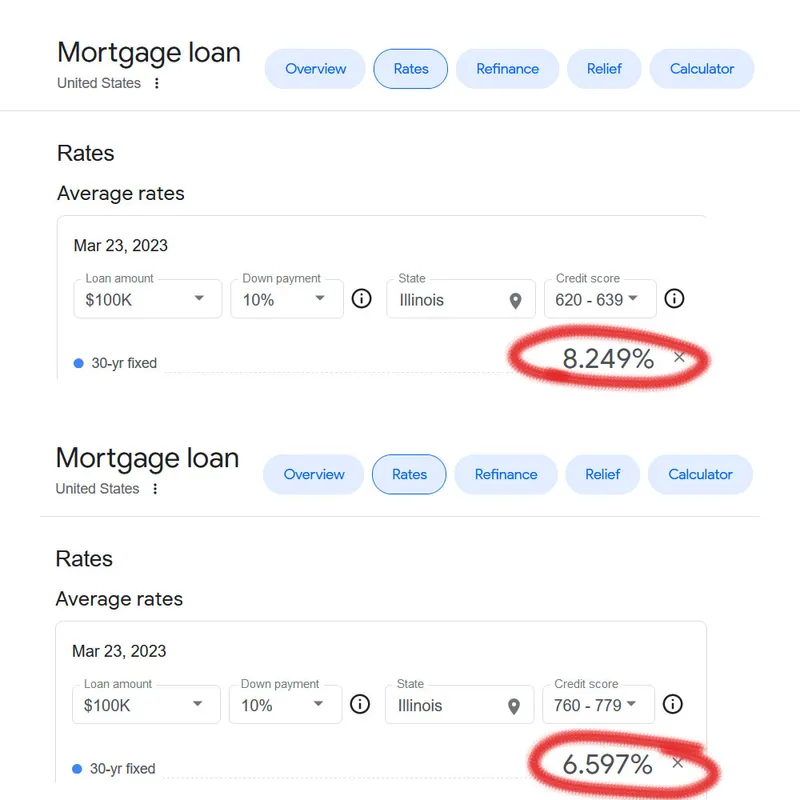

The image below shows today's cost of purchasing a $100k home on a 30-year fixed rate mortgage in Illinois with a 10 percent down-payment. The only differentiating factor of the two interest rates is the individual's credit score. The difference in interest is alarming (not to mention that it's already high), especially considering the actual amount of cash it will represent by the time repayment of the loan has been completed. This isn't just a few hundred dollars - we're talking about a whole lot of money here.

As we see above, a credit score of around 635 will put your interest rate at a swollen 8.25%, while the same exact loan would only cost you 6.6% - quite the difference.

But if you have a lower credit score, can you actually boost it 130 points in a short time and buy the home you're eyeing? Well, let's just say it's not unheard of but it'll require some strategy, and the knowledge of buying authorized user tradelines could be the key. You shouldn't rely solely on tradelines, but there's no telling what they can do for you - especially if you have no bad credit marks and simply lack the longevity that might be require to boost that score up.

While a 130 point increase may be extreme, you can see why any increase at all is a very important factor. Keep in mind, you can utilize tradelines again at a later date too, if and when the opportunity to refinance arises.

Anything Can Happen

You must always be prepared to expect the unexpected. Not only that but also be willing to make a solid and confident decision that sits well with your current financial situation and your future plans and goals too.

Let's say for example that interest rates on home mortgages drop to 3.4% around Christmas of 2024, and they do so within a mere month. You just bought your dream home the year prior and locked it in at 7.1% interest with the help of some carefully chosen credit card tradelines which increased your credit score 70 points. What would you do? Simple, purchase tradelines again, speak to your lender, and prepare to refinance (again, assuming you were careful and acquired a mortgage that allows for refinancing during any point of your loan). Not only would you be paying half the interest you were planning to pay, but you'll have the chance to bring tradelines into the picture again to work in your favor.

Taking Action Doesn't Have to Be A Gamble

You can't go on living in fear that a better deal will come around and you'll lose a ton of money. If you make the right choice the first time around it will be one that offers flexibility to drop down into a lower interest rate if the economy (and your mortgage agreement) allows. However, failing to act could leave you without the home you wanted, searching the market for something at a much higher cost and the same (or much, much higher) interest rate than today. So while we cannot advocate or guarantee anything as this decision is yours, we equally hate to see people sit by in idle, hoping for things that are completely out of their control to improve in the near future.

If you decide to act now, please understand your commitment and be very sure of what you can or cannot do with your mortgage loan in terms of future alterations or augmentation. Failure to do this could have you kicking yourself. But if you plan calmly, accordingly, and act without hesitation when you know you're in the best position possible from your own financial standpoint - including your credit score - then you should not be left with any regrets.

Take advantage of your ability to obtain knowledge and the functionality of the tools that are available to you as a consumer to enhance your credit score. Buying a home during difficult financial or economical times doesn't have to be the nightmare that so many people make it out to be.

Yes, you can buy what you want now, and do it with a smile on your face and confidence in your mind. All it takes is the willingness to achieve what you want without being swayed by temporary external factors. Would you prefer to wait - potentially years - to find out that buying a home is completely out of your reach? We sure wouldn't.

Reach out to GFS Group today for more information on what we can do to help your credit score. We would love to become a part of your personal success story.

PREVIOUS ARTICLE

What Are The Different Types of Tradelines

NEXT ARTICLE

How Buying Tradelines Can Provide A Better Financial Future