Applications For Home Mortgages Down By 28 Percent

Posted on 06 September, 2023 by MIRANDA BOTTAS in Economy

It's been a very long year for some of our best customers. As a company who specializes in tradelines for sale, we can't help but notice the news that home mortgage applications are down by 28% since the same week in 2022. That's quite a large number, and shows that over a quarter of the market is not attempting to finance a home right now. In fact, it's the first time in 27 years that the mortgage demand has dropped so low.

But there's a lot of history behind this. We've been writing about it, we'll continue writing about it, and we'll try to do our best to bring you the most important updates and information. With the economy leaping in different directions each day, it's not always so easy to pinpoint what's going on at any given moment.

Is now the time to buy? Should you wait? If so, why?

While we don't have all the answers and we're not financial advisors, mortgage analysts or real estate experts, our experience in the tradeline business tells us that this major decrease is a big deal. Let's see what we've been able to find out.

Why Have Home Mortgage Applications Slowed So Much?

One of the first things that comes to mind are high interest rates. It's been over a year now that the averages for 30-year fixed mortgages have remained elevated. At the same time, when they pull back a bit, it's very short-lived and not by a significant amount.

Let's use an example of how confusing and frustrating this can be for the typical homebuyer who's considering a mortgage, but relying on experts, news, and market numbers to try and understand when to pull the trigger.

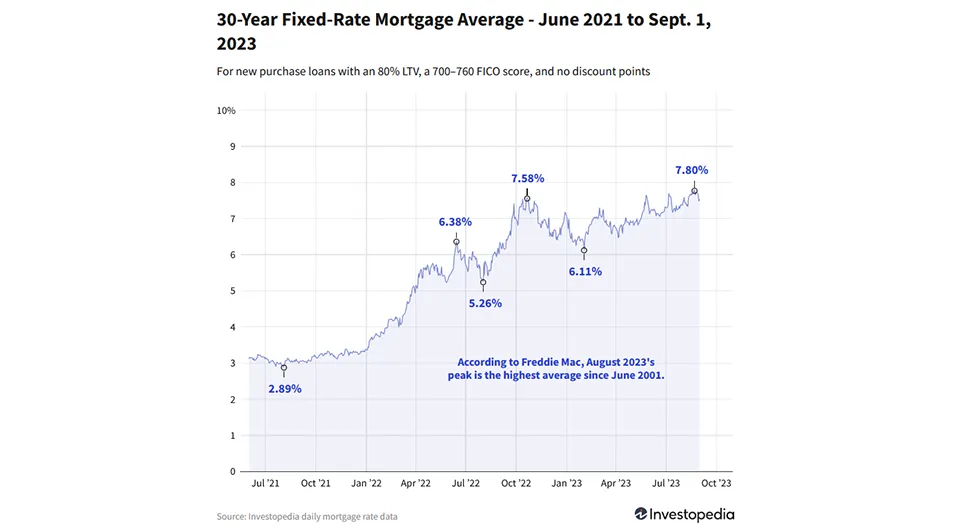

We'll begin with the fact that last year, from January to October, interest rates rose by over 100% - yes, they doubled - during a crazy and extremely volatile market. As The Mortgage Reports showed (backed by Freddie Mac's own numbers in an article they wrote:

"According to Freddie Mac's records, the average 30-year rate jumped from 3.22% in January to a high of 7.08% at the end of October. That's an increase of nearly 400 basis points (4%) in ten months."

Honestly, we think that number is a bit loose, but it puts things into perspective. Rates literally skyrocketed. Many people panicked and bought as fast as they could, and many decided to wait it out and buy during the spring or summer of 2023 when prices were predicted by the experts to revert or at least normalize somewhat. However, spring and summer came around and while rates fell back a tad, by June 1st of 2023 the average rate was a whopping 7.13%....(which really makes us wonder if the "experts" are even paying attention when making their predictions).

Are All The Mixed Messages Too Much To Deal With?

Here we are discussing the fact that mortgage applications are down 28% year-over-year this week, and really none of it seems to be a topic of discussion in the media. Are the general public fed up? Have they thrown in the towel and simply decided to stay put and wait for a genuine drop or risk not buying at all? It's quite possible. Imagine thinking you're ready to buy but the house you wanted a month ago is not for sale anymore, or that the rate drops you keep seeing only shoot up again the day you're considering applying for the loan. It's almost not worth the hassle. Anyway, let's get back to where we were at.

The last thing we mentioned were June 1st rates coming in at a hot 7.13% and that's already a big turn-off. But it gets even worse. Fast forward a mere month, and rates hit 7.7% - moving even higher.

Yes, again, there was minor fallback during that month but it never equated to less than 7.06% which is still extremely elevated.

Next, just a couple weeks ago, without dipping below the 7's, rates blasted off again and on August 22nd they clocked in at an alarming 7.8% average. What the heck is going on here? Does anyone really know? The worst part about this all is how tiny drops are celebrated and touted as "wins for the housing market" or "finally easing" while increases are mentioned as if they're nothing less than the expected normal. It almost seems like a big cruel joke.

To add gas to the fire, careless and seemingly reckless reporting hasn't helped. What are we talking about? Well, let's consider one of the most trusted online sources, Investopedia.

Investopedia is one of the places we like to pull information from, because they always have an abundance of great financial information. However, it's almost seems like they create some of their stories just to confuse people. What are we talking about? Let's take a peek at two articles, published within just six days of each other.

The first article, published on September 1st is titled "Mortgage Rates Begin to Recover". On that day, the average was 7.52%. Now don't forget that about 10 days prior, we were sitting at 7.80%, right? So it's an extremely far stretch (not to mention very premature of them) to proclaim that we were beginning to "recover". It's a bad choice of words, bad decision to publish, and really a flat-out pathetic use of the word "recover".

Are we being too harsh? No way! Let's show you why....

Just 5 days later here they are publishing a second article on June 6th titled "Mortgage Rates Jump by Double Digits". Well, quite a recovery, huh? And within that article they clearly state the following:

"Rates on 30-year mortgages spiked 16 basis points Tuesday, starting the week at 7.68%. That raises the flagship average to its highest level in over a week, while still remaining an eighth of a point below the 7.80% peak it registered August 22. That historic high point was the most expensive 30-year average in 22 years."

Consider what you just read. What type of reliable, responsible, ethical, and honest source of information for home buyers around the nation makes the bold claim that a recovery is beginning when they really have no clue? It's completely irresponsible. And it's not only Investopedia, the same thing is happening all over the place. Do your own research and you'll see that the sheer amount of information is overwhelming and there is never a clear, logical, or seemingly unbiased answer that uses supporting facts or layman's terms to discuss how and why this is all happening.

But, we can only deal with what we have available to us. So what's our decision? We're not even sure anymore, which is why we just say it's always a good time to buy. Literally, you never know what to expect so if you're waiting around, you're probably just wasting time. A year record high rates and now we have new record highs instead of the return to normal we were led to believe. The relief that most buyers expected never came, and they'd have been better off buying last year. What will late 2023 bring? We don't even want to think about 2024.

It's just so frustrating for most people. We can hardly believe our own eyes when we look at the data and compare it with the articles that were released over the last year. It's almost as if this were something intentional. There's really no other way for the logical mind to process this mortgage madness (we've just coined a new term there, we'll have to use that in the future as an article title if things get worse).

Will New Mortgage Applications Continue To Fall?

We have absolutely no idea. If we knew, we'd let you know. As you can see above, we're completely lost as to the real explanation behind these things.

Surely, getting back to school in September, continued inflation, the poor employment numbers, the amount of homes on the market for sale (or not for sale), and the variations of rates from state to state and on a case-by-case basis depending who you are and what you're buying all play into the final score. But that's not to say that what we've been seeing is highly misleading - and that's putting things lightly.

If people are not confident, and if the financial situation for the average Joe doesn't improve seriously within the next few months, we see no reason for people to begin popping out of the woodwork and begin applying for home mortgages in overwhelming numbers. Even if they did, the experts and specialists claim the prices are too high and that's due to demand and/or low availability - whichever seems to fit their story best. But in either case, nobody wants to pay an inflated and ridiculous interest rate for an overpriced home in a market that is all over the place during a completely unpredictable economy. We think that pretty much sums things up.

I'm Tired Of This - I Just Want To Buy A Home

If you're willing to battle volatile interest rates and purchase a home during a hard-to-find time, we're not trying to stop you. The truth is, we can help.

By checking out our inventory of tradelines for sale, you can easily see that we have plenty to offer you when it comes to making the best of a tough situation. If you want to minimize the down payment, repayment, and overall interest of your mortgage loan, a high credit score can make a big difference.

Every situation is unique, and while we don't know what our tradelines can do to help you specifically, there's only one way to find out - reach out to us today. Our expert team is ready and willing to guide you through the steps, or, help you understand if buying tradelines is a good decision for you in the first place. With almost 10 years of experience and an excellent history of customer service, there's no harm in taking the time to see what we can do for you.

PREVIOUS ARTICLE

The 3 Most Important Things To Know Before Buying Tradelines

NEXT ARTICLE

Now Is The Perfect Time To Sell Your Credit Card Tradelines